Trump’s Executive Order Creates Strategic Bitcoin Reserve & Digital Asset Stockpile

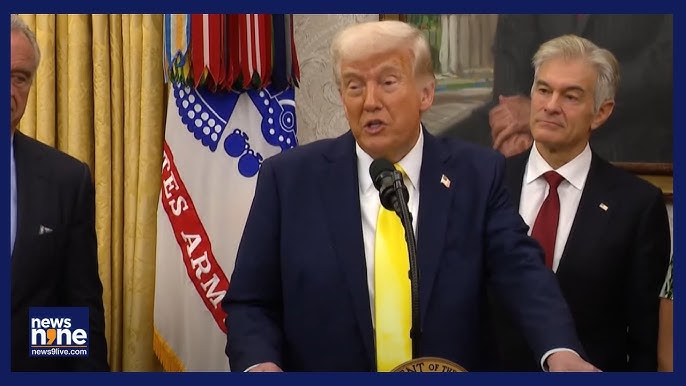

Former President Donald Trump has signed an executive order to establish a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, according to David Sacks, White House AI and Crypto Czar. Sacks announced the initiative on March 6 via a post on X (formerly Twitter), signaling a significant move toward making the U.S. a global leader in cryptocurrency.

What Is the Strategic Bitcoin Reserve?

The newly established Strategic Bitcoin Reserve will be funded with Bitcoin seized through criminal or civil asset forfeiture proceedings, ensuring that taxpayers bear no financial burden. This government-controlled reserve aims to serve as a long-term store of value, functioning like a “digital Fort Knox” for Bitcoin. Unlike previous government sales of confiscated Bitcoin—which reportedly cost taxpayers over $17 billion in lost value—this reserve will focus on holding assets strategically rather than liquidating them.

The executive order further mandates a full audit of the federal government’s digital asset holdings, an action that has never been conducted before. Current estimates suggest that the U.S. government owns approximately 200,000 Bitcoin.

U.S. Digital Asset Stockpile: A New Approach to Crypto Management

In addition to the Bitcoin reserve, Trump’s executive order also establishes the U.S. Digital Asset Stockpile, which will include digital assets other than Bitcoin that have been forfeited in legal proceedings. Unlike the Bitcoin reserve, however, the government will not actively acquire additional assets for this stockpile.

The U.S. Treasury Department will be responsible for managing the stockpile to ensure proper stewardship of the government’s digital asset holdings.

U.S. Crypto Strategy: Maximizing Value and Strengthening Leadership

Trump’s executive order also grants authority to the Treasury and Commerce Secretaries to develop budget-neutral strategies for acquiring additional Bitcoin, ensuring that new purchases come at no extra cost to taxpayers.

“This Executive Order underscores President Trump’s commitment to making the U.S. the ‘crypto capital of the world,’” Sacks said.

Earlier this year, Trump signed a Jan. 23 executive order creating the Presidential Working Group on Digital Asset Markets, which aims to analyze and shape the U.S. approach to crypto regulation and investment.

On March 2, Trump further detailed his plans for a U.S. strategic cryptocurrency reserve, listing potential holdings such as Bitcoin, Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA).

Key Takeaways:

- Strategic Bitcoin Reserve will hold government-seized Bitcoin, preserving value rather than selling it.

- U.S. Digital Asset Stockpile will store other confiscated crypto assets, but the government won’t actively buy more.

- A full audit of U.S. digital asset holdings is being conducted for the first time.

- The Presidential Working Group on Digital Asset Markets is shaping the U.S. crypto policy.

- Trump’s strategy aims to make the U.S. a dominant player in the global crypto industry.

This move marks a major shift in U.S. digital asset policy, potentially strengthening Bitcoin’s position as a reserve asset while reinforcing America’s status as a leader in blockchain innovation.