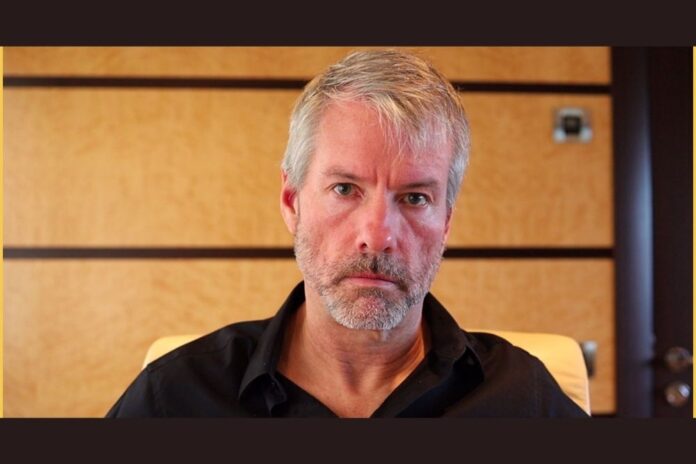

MicroStrategy co-founder and executive chairman Michael Saylor has once again captivated the Bitcoin community with a cryptic yet powerful message on X: “₿ig Strategy Day.” Known for his succinct yet impactful statements, Saylor’s words often hint at major developments in the crypto and corporate finance landscape.

What Does “₿ig Strategy Day” Mean for Bitcoin?

Saylor’s tweet has sparked widespread speculation. Could it signify a groundbreaking Bitcoin initiative, a strategic expansion of MicroStrategy’s BTC holdings, or a paradigm shift in institutional Bitcoin adoption? Given his track record, this teaser may precede a significant announcement that could reshape Bitcoin’s corporate integration.

MicroStrategy’s Unwavering Commitment to Bitcoin

Since August 2020, MicroStrategy has aggressively accumulated Bitcoin, becoming the largest publicly traded company with BTC holdings. This latest cryptic message could signal a new phase in the company’s Bitcoin strategy, potentially involving:

- Expansion of BTC Reserves: A fresh round of Bitcoin acquisitions to reinforce MicroStrategy’s dominant position.

- Bitcoin-Backed Financial Products: Introduction of yield-generating instruments leveraging BTC holdings.

- Institutional Bitcoin Frameworks: Development of structured corporate adoption models.

- Regulatory Strategy Adjustments: Navigating global compliance requirements amid evolving crypto regulations.

A Game-Changer for Institutional Bitcoin Adoption?

Beyond MicroStrategy, Saylor has been instrumental in promoting Bitcoin as a corporate treasury asset. He has hosted executive summits and led discussions on BTC’s role in inflation hedging and long-term wealth preservation.

“₿ig Strategy Day” might hint at an upcoming event where key industry leaders will discuss Bitcoin’s expanding role in corporate finance. If so, it could mark a pivotal moment for institutional Bitcoin adoption and treasury diversification.

Timing is Everything: Why Now?

Saylor’s message arrives at a critical juncture for Bitcoin:

- Approaching Bitcoin Halving (2024-2025): Historically triggers bullish market cycles.

- Institutional Momentum: Bitcoin ETFs are gaining traction, signaling mainstream investor interest.

- Global Economic Uncertainty: Rising inflation and shifting central bank policies are driving demand for alternative assets like Bitcoin.

Could Saylor be hinting at a strategic move aligning with these macroeconomic trends?

Saylor’s Signature Marketing Genius

Michael Saylor is a master at using concise, thought-provoking statements to generate anticipation. His latest tweet could be a well-orchestrated marketing move designed to engage the Bitcoin community, investors, and institutions worldwide.

What’s Next for Bitcoin?

While the true meaning behind “₿ig Strategy Day” remains a mystery, one thing is certain: Michael Saylor doesn’t make trivial statements. Whether it’s an expansion of MicroStrategy’s BTC holdings, a revolutionary corporate initiative, or a defining moment for institutional adoption, the implications could be massive.

The Bitcoin community eagerly awaits the reveal—will this be a landmark moment for the future of BTC?

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Readers should conduct their own research before making any investment decisions. Times Tabloid is not responsible for any financial losses incurred.