The cryptocurrency market has roared back to life, with Bitcoin reaching a record-breaking all-time high of $109,100. This surge comes after a period of consolidation driven by challenging macroeconomic data. Renewed optimism, sparked by the launch of Trump’s meme coin and his presidential inauguration, has energized the crypto community and lifted market sentiment.

While initial disappointment followed Trump’s lack of direct crypto mentions during his inaugural speech, subsequent policy developments from his administration bolstered market confidence, stabilizing Bitcoin around the $105,000 mark.

What Fueled Bitcoin’s Meteoric Rise?

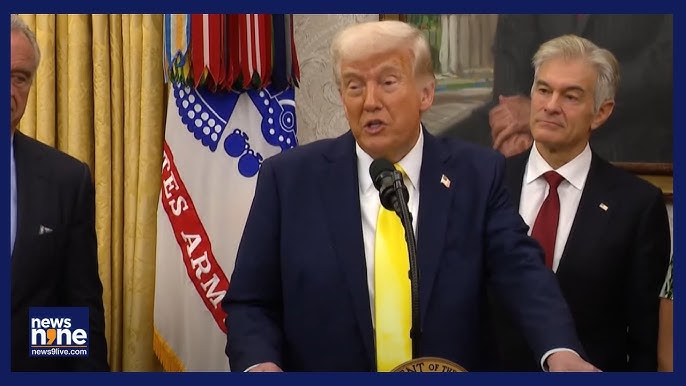

The Trump Effect: Meme Coins and Market Buzz

President Trump made headlines with the launch of $TRUMP, a meme coin celebrating his presidential return, which quickly surpassed a $14 billion market cap and ranked 18th globally. Adding to the frenzy, Melania Trump introduced her own meme coin, $MELANIA, which reached a $2 billion market cap at its peak.

Both coins, launched on the Solana blockchain, signaled an unprecedented level of state-endorsed engagement with the crypto market. The hype attracted retail investors, as indicated by a surge in Google search trends for crypto-related terms, driving a wave of new participants into the market.

Institutional Investors Make a Comeback

Institutional investors seized the opportunity during recent market corrections, injecting over $3.6 billion into Bitcoin ETFs over the past 10 days. Key factors driving this institutional confidence include Trump’s inauguration and softer-than-expected CPI data.

The Securities and Exchange Commission’s (SEC) decision to reverse the controversial SAB 12 accounting rule also played a pivotal role. This rule previously required firms to report crypto holdings as liabilities, creating administrative hurdles. Its removal has paved the way for institutions to allocate more capital to crypto assets.

Leading the charge, MicroStrategy expanded its Bitcoin holdings with a $243 million purchase, reaffirming its position as a corporate crypto pioneer.

State-Level Bitcoin Reserves Gain Momentum

The state of Oklahoma joined Ohio, Florida, and Pennsylvania in considering a state Bitcoin reserve. This initiative, aimed at hedging against inflation, aligns with President Trump’s broader vision of establishing a national Strategic Bitcoin Reserve. Trump further solidified his commitment by signing an executive order to create a national digital asset stockpile.

Regulatory Shifts: A Crypto-Friendly Approach

The resignation of former SEC Chair Gary Gensler marked a turning point for crypto regulation. Trump appointed crypto-friendly Mark Uyeda as interim SEC chair, and the establishment of a “Crypto Task Force,” led by Commissioner Hester Peirce, promises a more progressive regulatory framework.

The task force aims to tackle issues like market manipulation and investor protection while fostering innovation within the crypto ecosystem.

What’s Next for Bitcoin and the Crypto Market?

As the crypto market enters a new week, further reforms and developments are anticipated. While the upward momentum is promising, investors should remain cautious to avoid entering positions at unsustainable levels.

Technically, the market may remain range-bound as participants await the Federal Open Market Committee’s (FOMC) decision, which could significantly impact the economic outlook.

Weekly Crypto Performance Highlights

Top Gainers:

- Official Trump: Up 423%

- Raydium: Up 41.68%

- Solana: Up 21.01%

Top Losers:

- Sonic: Down 28.98%

- Pudgy Penguins: Down 24.27%

- Virtuals Protocol: Down 23.65%

Conclusion

Bitcoin’s surge to new heights showcases the growing influence of both institutional and retail investors, driven by a mix of regulatory changes and high-profile endorsements like Trump’s meme coin launch. However, as the market evolves, staying informed and exercising caution will be crucial for navigating the volatility and maximizing opportunities in this dynamic ecosystem.