The Bank of Russia has unveiled a groundbreaking three-year experimental legal framework that restricts cryptocurrency trading to a select group of high-net-worth investors. This move aligns with President Vladimir Putin’s directive to regulate crypto investments while maintaining a cautious stance on digital assets.

Russia’s Stance on Crypto: Regulate, Not Embrace

Despite allowing limited crypto trading, Russia remains firm in rejecting digital currencies as a legal payment method. The government plans to impose penalties on those conducting crypto transactions outside this experimental framework. This cautious approach raises questions about Russia’s long-term crypto strategy, especially considering Putin’s previous acknowledgment of Bitcoin’s [BTC] value while dismissing its stability for international trade.

Who Qualifies for Russia’s Elite Crypto Access?

The Bank of Russia’s proposal limits participation to the wealthiest investors, setting strict financial criteria:

- Individuals must hold at least 100 million rubles (~$1.15 million) in securities and deposits, OR

- Earn an annual income of at least 50 million rubles (~$583,960).

Retail investors are excluded, while select financial institutions meeting regulatory criteria will be permitted to trade under additional oversight. The central bank is implementing stringent regulations to manage risks associated with cryptocurrency investments.

Russia’s Ban on Crypto Payments Remains Firm

Although this experimental regime opens doors for crypto trading, the Bank of Russia emphasizes:

“The Bank of Russia still does not consider cryptocurrency as a means of payment. Therefore, it proposes to also introduce a ban on settlements between residents on transactions with cryptocurrency outside the experimental legal regime, as well as establish liability for violating the ban.”

This aligns with Russia’s existing crypto law, “On Digital Financial Assets,” which has banned crypto payments since January 2021.

Putin’s Evolving View on Bitcoin

Putin’s stance on Bitcoin has shifted over time:

- October 2021: He acknowledged Bitcoin as a potential “payment unit” but warned about its volatility.

- December 2024: Putin admitted that “nobody can ban Bitcoin,” coinciding with BTC’s surge past $100,000.

Despite acknowledging Bitcoin’s resilience, Russia remains hesitant to integrate it into its financial system fully.

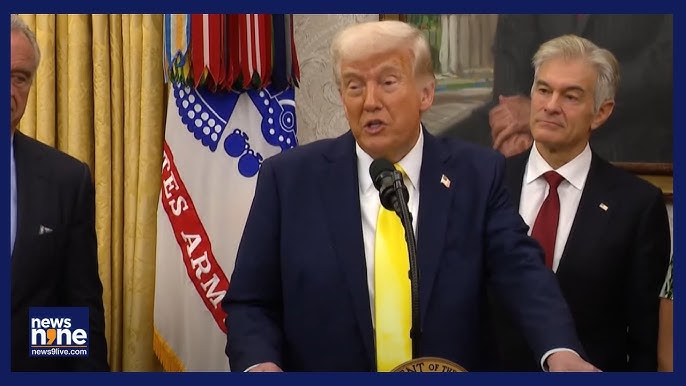

Bitcoin as a Reserve Asset? Russia vs. U.S. Strategies

While Russia debates Bitcoin’s role in its reserves, the U.S. has taken a proactive approach. Under President Donald Trump’s administration, the U.S. established a strategic Bitcoin reserve, acquiring 200,000 BTC (~$17.5 billion) as part of its national security strategy.

In contrast, Russian officials remain skeptical about Bitcoin’s place in sovereign reserves. Anton Tkachev, a State Duma Deputy, recently suggested adopting Bitcoin as a hedge against sanctions and inflation, arguing:

“In conditions of limited access to traditional international payment systems for countries under sanctions, cryptocurrencies are becoming virtually the only instrument for international trade.”

However, Vladimir Kolychev, a top financial policymaker, dismissed Bitcoin’s inclusion in the National Wealth Fund, emphasizing that the reserves will continue prioritizing gold (40%) and yuan (60%) due to their liquidity and stability.

Russia’s Crypto Future: Caution or Commitment?

Russia’s cryptocurrency strategy remains a balancing act—allowing limited trading for wealthy investors while avoiding full-scale adoption. While Putin acknowledges Bitcoin’s growing influence, his government remains cautious. A national Bitcoin reserve appears unlikely in the near future.

Meanwhile, the U.S. is accelerating its crypto dominance by embracing Bitcoin as a strategic asset under Trump’s leadership. As global markets evolve, Russia’s crypto stance may shift, but for now, its approach remains a mix of progress and hesitation.